Why will Home Prices not fall anytime sooner?

Ever since mortgage rates have gone up, I have received a lot of questions on what is happening to home prices. In the following section I will cover some of those.

Supply and Demand are not at equilibrium

- At the outset of pandemic more homeowners have refinanced their mortgages to a lower rate. These homeowners are in no mood to sell in this rising rate environment. The supply of homes is still historically at lower levels than it has been due to supply chain issues, lockdown, and other macro-economic factors.

- The process of construction has slowed down tremendously due to the supply chain shortage and labor shortages.

- Most builders are still operating with reservation list.

Competition is high

- The stock market boom has also contributed to the increase in home prices. There are more cash buyers today than there have historically been. This is adding strain on first time home buyers. Most buyers are stretching to buy their dream home and a lot of contracts are written with appraisal waiver clauses. This will eventually slow down as liquidity is flushed out of the market.

Accessing Credit is not easy today

- Ever since the collapse of the housing market. Credit and underwriting requirements have become increasingly stringent. Most Americans are still not able to qualify for home purchases.

Prices are still historically high, and rents have gone up. This will prevent consumers from saving on down payments.

- The Fed has started playing its part in raising rates and taking their foot off the gas pedal from stimulating the economy.

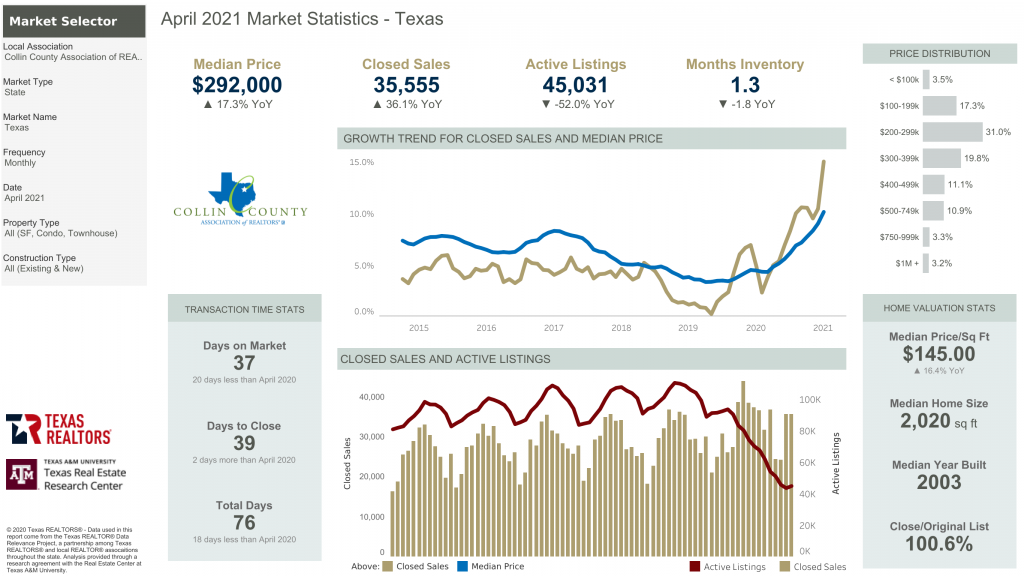

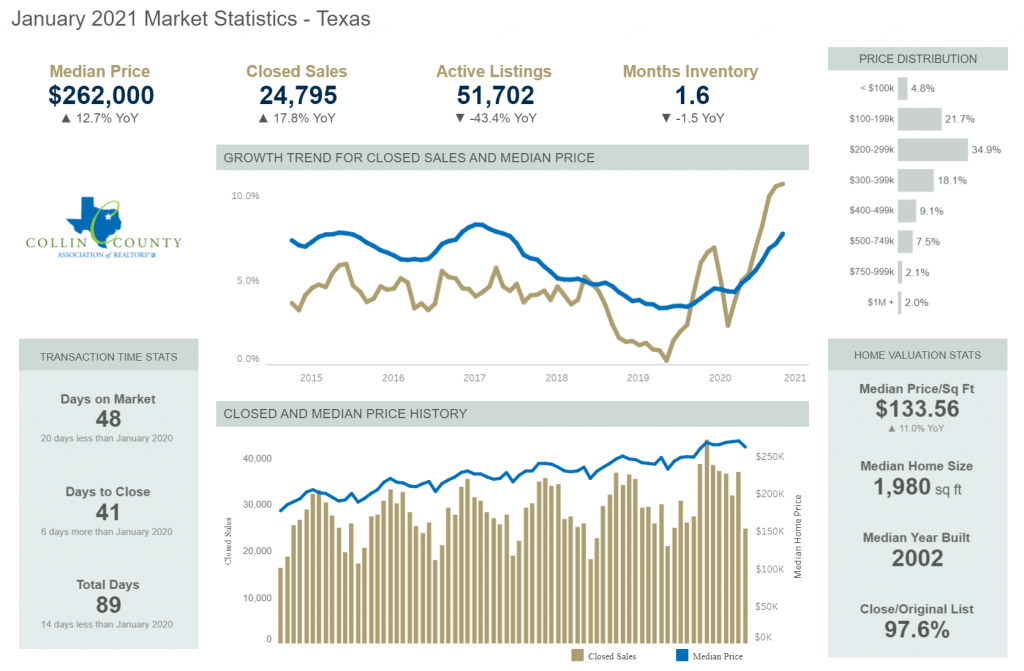

- The Median prices of homes in DFW as of the latest data from Texas Real Estate Center in Dallas County has gone up by 19% compared to March 2021

- Month of inventory is at 0.8

- Increasing rent has prevented American consumer from saving for down payment towards purchase of their home.

Inventory is low – Listing of Preowned homes are drying up.

- A lot of homeowners capitalized on sellers’ markets and sold their homes cashed in their Equity where in some of them downsized, most upsized to homes with dedicated office spaces and multiple rooms.

- The influx of out-of-state residents from states such as California, New York, and New Jersey in search of warmer weather and larger homes has depleted the inventory further.

- Most homeowners have preferred to stick to their homes for now as they have locked in historically low fixed mortgage rate.They are in no mood to move out and buy something at soaring prices and higher rates.

- Builders are building less as they too are also feeling the pinch of rising rates.

Inflation is eating away Affordability

- The top-line inflation reading for May was 8.3 as inflation is going up and the affordability of homes is deteriorating. The cost of raw materials compounded with the supply chain problem has made affordability difficult

According to the NAR’s Home Affordability Index, national housing affordability fell in March compared to the previous month.

- The Midwest was the most inexpensive area, with an index score of 170.6. The West remained the least affordable area, with a score of 97.1.

- In March, affordability deteriorated as monthly mortgage payments rose 32.0 percent while median household income decreased 6.6 percent.

- From the previous month, affordability was lower in all areas. At 25.7 percent of income, the West has the greatest mortgage payment to income proportion. At 14.7 percent, the Midwest had the lowest mortgage payment as a proportion of income.

Mortgage Payments have gone Up

The American consumer is paying more towards their mortgage than they used to pay a year ago. if they have purchased their home after the recent rate hikes.

The normalization in home prices especially in certain cities of DFW metro may take time.

There are four things that need to happen before normalization

- Supply and demand has to get back to normal levels.

- War in Ukraine and zero Covid policies in China would have to ease so supply chain can be normalized especially energy supply and other finished products that is contributing to escalating inflation.

- The current ongoing volatility caused by the Fed in its fight against inflation is not helping going to help the consumer in short and medium term. Fed has already given sufficient warning in its fight on inflation . Inflation would have to drop to meaningful and acceptable levels for fed to stop raising rates.

- In the process to contain the inflation the Fed may cause a recession. Fed’s Softish landing is highly unlikely. I see gyration in equity and bond markets.

Until these four things happen, we are not going to see a broader normalization in prices. There may be pockets where the prices may come down but not broadly. We may hear and there news snippets on decline in mortgage application, but that will not be meaningful to prices.

Last but not least, We are in for a long haul as far as normalization of prices is concerned. Each of these points will take time some are in Fed’s control especially the demand side but others are out of its control (Supply Side). Equity Markets will flush first. I hate to say this but, people will have to panic sell the equities before the housing markets starts to see the effect. We are still not at that point. All signs points to a multi-month or multiyear grind of ups and down.

My take of the current Market conditions

- The Fed recent warning on getting inflation under control with softish landing of the economy currently is questionable.

- Equity markets have not yet priced in the recession factor which is highly likely given the acceleration in asset prices recently across the board.

- The effect of recession on housing prices is not yet fully understood as we have not seen something like this in a while.

- The 2008 financial crisis was caused due to laxity in credit and underwriting requirements leading to subprime mortgage crisis.

- This is not the case today. Credit is still tight, consumers are strong. Equity markets are not fully flushed.

- Last but not least consumer are sitting on the highest home equities in long time. We are still not at the point where there is fear or capitulation leading people to tap on some of their hard-assets. We are still far off from any meaningful correction in Housing markets.

If you have a friend or family members looking to Buy/Sell/Lease Residential or Commercial Properties. We are here to help you and and your loved ones.

Let us help you find the home where your dreams come true